Copenhagen's Legacy Is Ambiguity

The third Ifri Annual Energy Conference held at the Plaza Hotel, Brussels in February 2010 posed the question: “How do we begin effectively to close the gap between climate change policies and current practices - or put another way between climate change rhetoric and market reality”.

We are collectively practicing little of what we preach. There was little ambiguity on the magnitude of the problem confronting mankind that puts us on a collision course with serious climate instability as accepted reference scenarios project CO2 emissions rise over 200% by 2050. Technically feasible options for mitigating greenhouse gas emissions are available but they are not enough. Huge efficiency potential exists in all our economies, but progress is slow in correcting market imperfections or making the adjustments to lifestyle inherent in realizing obvious efficiency gains. There do not appear to be insurmountable costs to achieving sustainability - just a lack of willingness to pay. Much of the easiest mitigation is even at net negative cost and the higher costs of low carbon options offer other offsetting benefits in employment and trade in greener technologies. The capital requirements for sustainability are not beyond the world’s reach, but we have not found the formula to mobilize that capital.

The economic collapse of 2008-2009 does not appear to have had a defining impact on the energy sector except temporarily to disrupt markets, growth and investment plans. The nature of the challenges emerging with economic recovery has not changed substantially from the problems ex ante, e.g. slow turn over in capital stock, flawed markets where huge investment is required, ambiguity for energy investors both in infrastructure and the energy commodities themselves. These are aggravated by confusing disagreements on future demand for oil and gas and politically driven targets for low carbon options like renewable and bio-fuels. This leaves energy investors confused.

Uncertainties about energy demand growth have medium term implications for whether investment in the supply of energy infrastructure and commodities will be sufficient to meet growing demand in late decade. Ambiguity has the consequence of delayed or postponed investments now. Delays in investment in low carbon energy infrastructure and technology mean a loss of the limited time humanity has to reach the peak of carbon emissions and start a downward track.

Pervasive through the conference was an awareness that much of the challenge of the next decades is outside the countries of the OECD. The emerging world reasonably aspires to economic growth and improving welfare, but the planet cannot tolerate the desired growth in emerging countries if they have no option but to follow the OECD example of carbon intensive growth. How do we act collectively so that the emerging world can afford to deploy lower carbon technologies even as the industrialized countries dramatically reduce their own carbon footprint? Speakers at the Ifri conference reflected the sharply diverging views of Copenhagen negotiators on this central dilemma and lamented the lack of an emerging consensus on how this burden will be shared and who will start? It is obvious that the EU needs to adapt its strategy after Copenhagen as the offer to step up Europe’s pledge to a 30% reduction drew no support.

Conference participants left little doubt that the single most important requirement for those who must invest in the future - is less ambiguity about the rules of the game. Copenhagen left altogether too much ambiguity. Do national policy commitments to a lower carbon future go beyond politicians" targetry? Will clear policy parameters be set and when? Can regulations which apply equitably be put in place to guide investments? Can stable policy and price signals be established that permit cost-benefit assessments of investment options?

These conclusions of Ifri’s Annual Energy Conference were no doubt self-evident to some going into it. But it is clear these truths have not been taken to heart by our populations and politicians - perhaps intellectually but not materially. Some say Copenhagen was the end of the beginning and 2010 will show the start of serious negotiations. Perhaps, but each year that is lost in answering the challenge raises the long term cost to society of paying the consequences of inaction.

Available in:

Regions and themes

Share

Related centers and programs

Discover our other research centers and programsFind out more

Discover all our analysesCan carbon markets make a breakthrough at COP29?

Voluntary carbon markets (VCMs) have a strong potential, notably to help bridge the climate finance gap, especially for Africa.

Taiwan's Energy Supply: The Achilles Heel of National Security

Making Taiwan a “dead island” through “a blockade” and “disruption of energy supplies” leading to an “economic collapse.” This is how Colonel Zhang Chi of the People’s Liberation Army and professor at the National Defense University in Beijing described the objective of the Chinese military exercises in May 2024, following the inauguration of Taiwan’s new president, Lai Ching-te. Similar to the exercises that took place after Nancy Pelosi’s visit to Taipei in August 2022, China designated exercise zones facing Taiwan’s main ports, effectively simulating a military embargo on Taiwan. These maneuvers illustrate Beijing’s growing pressure on the island, which it aims to conquer, and push Taiwan to question its resilience capacity.

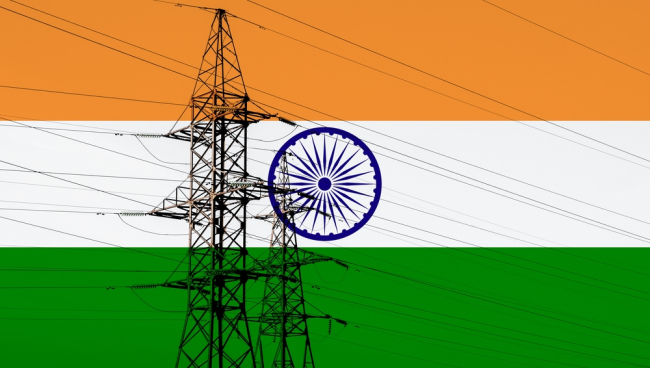

India’s Broken Power Economics : Addressing DISCOM Challenges

India’s electricity demand is rising at an impressive annual rate of 9%. From 2014 to 2023, the country’s gross domestic product (GDP) surged from 1.95 trillion dollars ($) to $3.2 trillion (constant 2015 US$), and the nation is poised to maintain this upward trajectory, with projected growth rates exceeding 7% in 2024 and 2025. Correspondingly, peak power demand has soared from 136 gigawatts (GW) in 2014 to 243 GW in 2024, positioning India as the world’s third-largest energy consumer. In the past decade, the country has increased its power generation capacity by a remarkable 190 GW, pushing its total installed capacity beyond 400 GW.

The Troubled Reorganization of Critical Raw Materials Value Chains: An Assessment of European De-risking Policies

With the demand for critical raw materials set to, at a minimum, double by 2030 in the context of the current energy transition policies, the concentration of critical raw materials (CRM) supplies and, even more, of refining capacities in a handful of countries has become one of the paramount issues in international, bilateral and national discussions. China’s dominant position and successive export controls on critical raw materials (lately, germanium, gallium, rare earths processing technology, graphite, antimony) point to a trend of weaponizing critical dependencies.