South Africa’s Energy Policies: Are Changes Finally Coming?

Energy and electricity policy, planning and regulation in South Africa has been slow and bureaucratic, lacking visionary leadership, and marred by uncertainty. Policy positions and actions taken have tended to be reactive, and driven more by crisis management than by forward-looking leadership.

National energy policy and planning

In 1998, the Government White Paper on Energy Policy detailed a policy of restructuring and liberalization of the electricity supply industry (ESI). However, it became clear that the political and executive leadership in national, provincial, and local government, and the various affected ministries, were not of a common mind on the matter, and the ESI incumbents (national electricity utility Eskom, and municipalities) had little appetite to restructure themselves. To date, not one of the above stated policy objectives in respect of the restructuring of the ESI has been met, even though the 1998 policy document remains in place to this day.

This policy uncertainty, together with a rapid turnover of ministerial leadership at the Department of Energy, has resulted in integrated planning within the energy and electricity supply sectors being intermittent, uncoordinated, and lacking coherence, at best.

The planning that has taken place has been done in the absence of a published national Integrated Energy Plan (IEP). Section 6(1) of the National Energy Act, Act 34, 2008 requires that an IEP be developed, reviewed, and published annually by the Minister of Energy. However, to this day, a final IEP has never been published since 2008 when the Act was first promulgated.

Electricity policy: plans for 25 GW of renewables

Following the publishing of an integrated resource plan (IRP) for electricity, IRP 2010-2030 in 2011, there was a seven-year delay before this was finally updated and replaced with a revised IRP 2019 covering the next decade to 2030.

The new IRP 2019 indicates the planned decommissioning of 11.5 gigawatts (GW) of old coal-fired power plant, and a major new-build comprising 14.6 GW of utility-scale wind, 6.0 GW of utility-scale solar photovoltaic (PV), and about 5 GW of distributed self-generation by electricity consumers, all complimented by 3 GW of gas- or diesel-fired power, and 2 GW of battery storage.

In addition, IRP 2019 has what some consider to be “smoke and mirror” inclusions to appease various stakeholder groupings, such as 1.5 GW of new coal-fired power, 2 GW of hydropower imports and 1.8 GW of nuclear power.

The 1.8 GW of nuclear power is of course not a nuclear new-build at all, but simply a 20-year extension of the operating license of the existing Koeberg power station in the Western Cape. The 1.5 GW of new coal power will, in all likelihood, never be built, due to difficulties in obtaining funding. The 2.5 GW of imported hydropower from the Inga Project by 2030 is generally considered to be a pipedream, to disguise other plans to replace this unlikely option with 2.5 GW of new nuclear power, which is equally unlikely to take place by 2030, if at all.

Coal policy: managing an inevitable crisis

The coal mining industry itself produced the so-called “National Coal Strategy for South Africa” in 2018, to determine what needs to be done in the face of negative public opinion around the use of coal in power generation and industrial processes.

However, there is a growing awareness within government, by the coal mining majors and by the financial sector, that coal mining in South Africa is a declining industry under threat. Despite being well behind the curve as one of the most carbon intensive economies in the world, the realization of the need for decarbonization of the economy is beginning to assume traction. However, distracting talk of clean coal technologies, underground coal gasification and carbon capture and storage is still heard emanating from the Department of Mineral Resources and Energy (DMRE) and other quarters, demonstrating a lingering commitment to coal as a source of primary energy.

No nuclear new builds in sight

The official commitment to a nuclear power new-build program has fluctuated significantly over the past 15 years. While no new nuclear power is shown in IRP 2019 for the years to 2030, it is worth noting the decision in the IRP to “commence preparations for a nuclear build program to the extent of 2500 MW at a pace and scale that the country can afford because it is a no-regret option in the long term”. However, it should not be assumed from this statement in the IRP that a nuclear new-build in South Africa will actually take place.

It would seem that the Minister of Mineral Resources and Energy and the nuclear sector in South Africa are pinning their hopes on the deployment of small modular nuclear reactors (SMRs) with designs that have, as yet, still not been finalized, built, licensed, piloted and proven to be safe and economically viable for commercial power generation.

Gas policy

A draft Gas Utilisation Master Plan (GUMP) was released by government in May 2016 for public comment. However, the final version of GUMP never made it into the public domain. Planning for imported liquified natural gas (LNG), compressed natural gas (CNG), liquified petroleum gas (LPG) and shale gas, therefore remains uncoordinated and haphazard. However, major developments of gas fields in Mozambique, as well as two significant recent gas condensate discoveries by Total some 175 kilometers (km) off the southern coast of South Africa, has awakened the interest of the current Minister of Mineral Resources and Energy, who regularly states that “gas is a game-changer in South Africa”. But the slow pace of planning and development of the necessary of gas infrastructure in South Africa is likely to inhibit the establishment of the sector and the uptake of gas for industrial and power generation by potential customers.

Renewable energy policy and planning

By far the biggest portion of the new-build in IRP 2019 for the years to 2030 comprises wind and solar PV, backed up with flexible generation in the form of gas-to-power and battery energy storage. This reflects the fact that this is indeed the preferred option that delivers reliable, dispatchable electricity at least cost, with least water use and lowest emissions, while creating the most jobs and meeting South Africa’s climate change commitments.

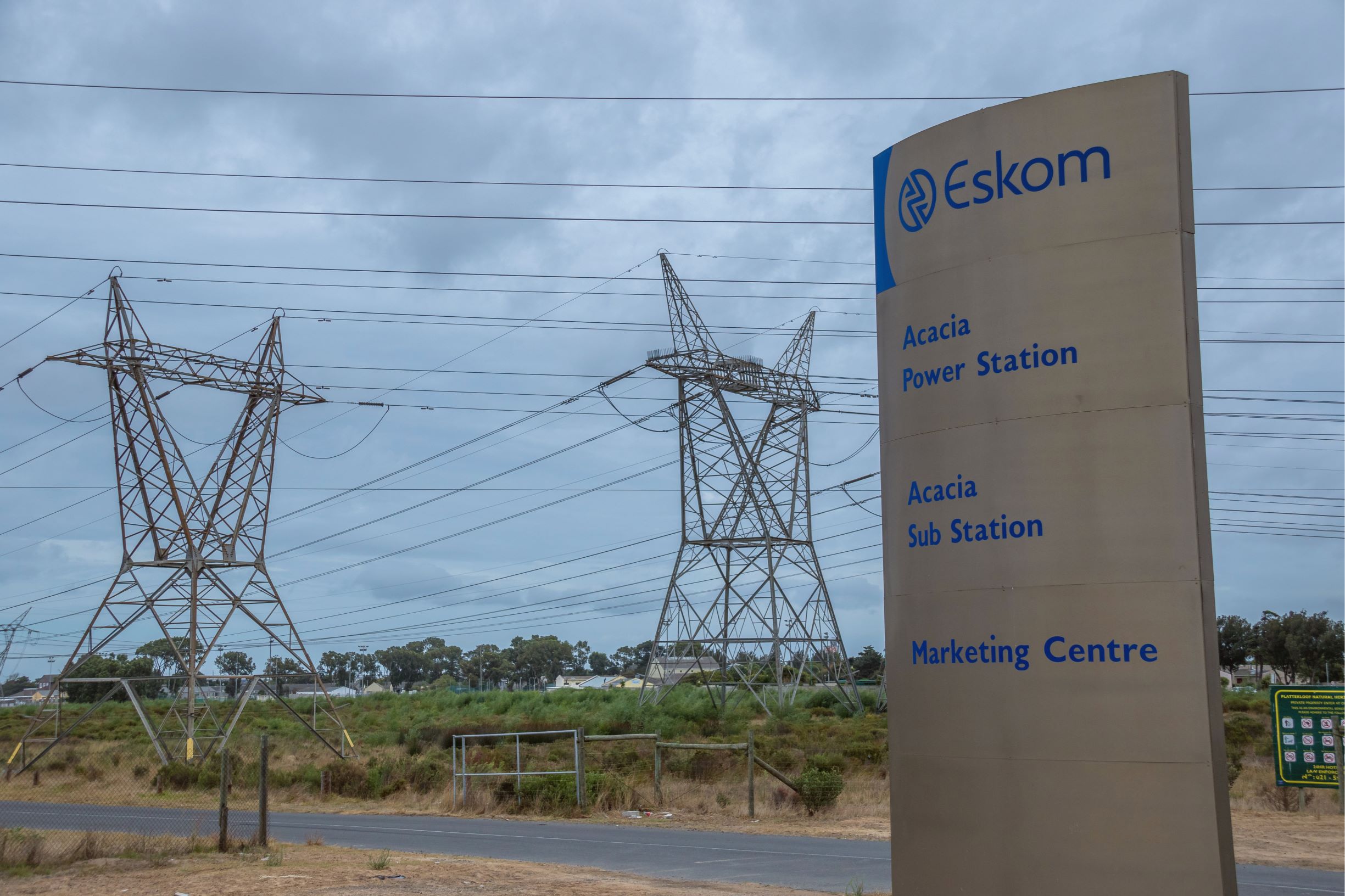

There is also a growing realization, including by Eskom itself, that the utility-scale renewable energy build program in IRP 2019 has to be significantly increased even further in order to meet the falling output from Eskom’s old coal-fired power stations, due to declining availability and the pressure from lenders for an accelerated decommissioning and decarbonization schedule.

However, the uptake of renewable energy detailed in IRP 2019 is constrained by policy interventions in the form of artificial and arbitrary limits on the capacity of annual deployment of wind and solar PV power plants, of 1,600 megawatts (MW) per annum for wind, and 1,000 MW per annum for solar PV.

Self-generation, distributed generation, and wheeling

It is becoming apparent that centrally planned procurement of generation capacity of all technologies by the DMRE and its Independent Power Producer (IPP) Office will not be able to meet the immediate needs for increased generation capacity to avert the threat of rolling power cuts or load shedding in South Africa in the next two to three years.

With Eskom not even able to meet declining demand, there is also a growing realization by all electricity customers that they need to work on self-generation to supplement their grid electricity needs, as well as to wheel power for their own use from external sources of distributed generation.

Policy, legal and regulatory reform

However, to make the above possible and to facilitate an immediate uptake of distributed generation at scale for own use, as well as to facilitate a diversified and competitive power generation sector, there is an urgent need for policy, legal and regulatory reform and restructuring of the electricity supply industry (ESI).

There are encouraging policy statements and commitments from political leaders in government indicating a change in mindset to enable the unbundling and restructuring of Eskom and to create a state-owned independent transmission system and market operator (ITSMO) with power planning, procurement, contracting and system operation functions.

This would facilitate a diversified, competitive generation sector with non-discriminatory access to the grid on level playing fields by new entrants, incumbent Eskom generators, municipal generators, large public-private partnerships (PPPs), independent power producers (IPPs), distributed generation and self-generation.

The stifling regulatory red-tape, technical barriers and complex registration and licensing processes associated with distributed generation, self-generation and wheeling need to be eliminated, or at least streamlined. These include requirements applicable to domestic and small commercial installations up to 100 kilowatts (kW), commercial and agricultural installations of 100 kW to 1 MW and higher, and industrial and mining installations greater than 10 MW.

Liquid fuels, ammonia, and hydrogen

South Africa has no crude oil reserves, and liquid fuels are produced by refining imported crude oil, and the local production of synthetic liquid fuels from coal and gas. There are six aging refineries, which are supplemented by significant imports of cleaner liquid fuels.

Declining local refining capacity, planned and unplanned outages at South Africa’s aging refineries, together with the long timelines to purchase, transport, offload and distribute imported fuel stock, together with limited storage capacity, is leading to intermittent petrol and diesel fuel shortages.

Refineries are hesitant to invest in modernizing and expanding their plants due to policy and regulatory uncertainty, the high costs, and a lack of clarity on cost recovery mechanisms in the regulated pricing environment. However, there is a possibility that Sasol may upgrade its 150,000 barrel-a-day Secunda synthetic fuel operation to meet the cleaner fuel standard.

At this stage, there is no formal published South African government policy or strategy yet on the role and production of green hydrogen. However, the Hydrogen South Africa (HySA) strategy and Hydrogen Society Roadmap is work in progress under the auspices of the Department of Science and Innovation, the Council for Scientific and Industrial Research (CSIR), Mintek and a number of universities.

There is a growing appreciation that the production of green hydrogen and green ammonia in South Africa offers significant competitive advantages, that can be used for domestic decarbonization of transport and industry alongside exports. These include abundant wind and solar natural resources, cheap and available land, and 50 years of experience in the commercial production of synthetic fuels using the Fischer-Tropsch process.

Perspectives

The former Department of Mineral Resources (DMR) merged with the Department of Energy (DoE) in early 2020 to form the DMRE. This created the need for significant structural and people change-management, which slowed the work of the Department in the energy sector, and also created some conflicts of interest between serving coal mining interests and the need to decarbonise the South African economy.

Within the Department, there is still distracting talk of clean-coal technologies, underground coal gasification, carbon capture and storage, and futuristic nuclear power technologies that do not provide economically viable, flexible, and proven solutions to electricity generation capacity shortfalls in the short and medium term.

However, there are indeed some positive and pragmatic statements and policy positions now coming from political leaders and government. Some examples include: the restructuring and unbundling of Eskom, which is inevitable as the company is insolvent and needs massive bailouts; the need for regulatory reform and the easing of regulatory red tape; the establishment of an independent transmission system and market operator (ITSMO); the opening of the power generation sector to municipal generators, distributed generation, self-generation, and wheeling; and the need for decarbonization of the economy and a just energy transition.

Going forward, government needs to provide clear, unambiguous, and reliable policy positions and messaging to attract investment and to encourage the participation of the private sector.

Download the full analysis

This page contains only a summary of our work. If you would like to have access to all the information from our research on the subject, you can download the full version in PDF format.

South Africa’s Energy Policies: Are Changes Finally Coming?

Related centers and programs

Discover our other research centers and programsFind out more

Discover all our analysesAI, Data Centers and Energy Demand: Reassessing and Exploring the Trends

The information and communication technologies sector today accounts for 9% of global electricity consumption, data centers for 1-1.3%, and artificial intelligence (AI) for less than 0.2%. The growing energy demands of cloud services first, and now AI workloads (10% of today’s data centers electricity demand), have exacerbated this trend. In the future, hyperscale data centers will gain shares amongst all kinds of data centers and AI will probably account for around 20% of data centers electricity demand by 2030.

Unlocking India’s Energy Transition: Addressing Grid Flexibility Challenges and Solutions

India is rapidly scaling up its renewable energy (RE) capacity, adding 15–20 GW annually, but the ambitious goal of 500 GW of non-fossil capacity by 2030 is at risk unless the pace accelerates.

Europe’s Black Mass Evasion: From Black Box to Strategic Recycling

EV batteries recycling is a building block for boosting the European Union (EU)’s strategic autonomy in the field of critical raw minerals (CRM) value chains. Yet, recent evolutions in the European EV value chain, marked by cancellations or postponements of projects, are raising the alarm on the prospects of the battery recycling industry in Europe.

The New Geopolitics of Energy

Following the dramatic floods in Valencia, and as COP29 opens in Baku, climate change is forcing us to closely reexamine the pace—and the stumbling blocks—of the energy transition.