Russian Gas: Reminder of Yesterday Presaging Tomorrow?

One can’t help but be struck by the irony earlier this week of Russian President (ad-interim) Medvedev celebrating the landing of gas in Lubmin Germany from the Nordstream gas pipeline from Russia while Former President and President-in-waiting Putin welcomes Chinese Premier Wen Jiabao to seek a deal to send Russian gas east to Chinese markets.

Gazprom and the EU: Raiding the Gas Companies

It was a matter of time before the Commission competition authorities looked into the business arrangements between Gazprom and its European partners. Some would ask why it took so long.

Trans Caspian Gas: A Worthy Teething Ring for Europe's Energy Diplomats

As an early task in its efforts to build a common external energy policy, the Commission has announced it will turn its attention to bringing the vast gas resources of Turkmenistan to European consumers. This will be an excellent place for the Commission to test its ability to speak with one voice for its polyglot constituency. First, their task may be facilitated by the fact that on this topic, no European voices are yet particularly audible.

Unconventional Gas: A Game Changer for Transport Too?

A new technology trend, the development of natural gas vehicles, is emerging in the transport sector.

The Effects of Baghdad Politics on Kurdistani Gas Prospects

This paper examines the effects of internal Iraqi politics on the potential for exporting Kurdistani natural gas. It examines Baghdad’s policy with regards to both oil and gas, and predicts what effects it will have on Kurdistan’s gas prospects.

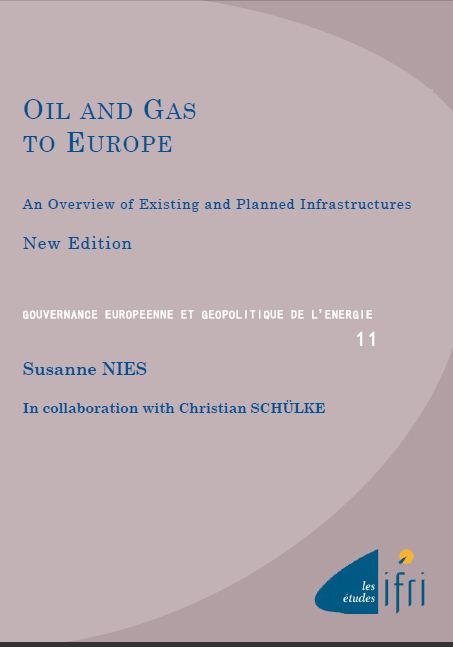

Oil and Gas Delivery to Europe: An Overview of Existing and Planned Infrastructures. New Edition

The European Union’s hydrocarbon energy supply depends heavily on imports. While the European Commission has recommended diversifying and increasing domestic resources, notably with renewable resources which should grow to 20% by 2020, dependence on hydrocarbon imports will remain not only substantial, but will increase.

Nordstream: Just-in-time?

Last week the gritty Russian/Ukrainian gas relationship was back in the press. This time the issue appeared to be Ukraine’s efforts to secure lower prices for its consumers - perhaps even on a par with Russia’s domestic consumers. The Ukrainians must surely know that to qualify for those kinds of special prices available previously only to politically compliant neighbors - Ukraine would have to return to some form of pre-Orange Revolution relationship with Mother Russia.

An Azeri-Turkish deal on gas - a partnership renewed

The package of the Azeri-Turkish gas agreements signed in Istanbul on June 7, 2010, in the presence of President Ilham Aliyev and Prime Minister Recep Erdogan certainly makes cooperation easier in a sector which both parties consider to be strategic. It does not, however, specify all details of the sale and transit of gas (see e.g. EurasiaNet, 7 June). The documents above all have important political significance.

Russian Gas Diplomacy

Thank goodness our early warning systems during the cold war were not structured so we could see the flash at the same time we heard the warning. On Monday, the Russians notified the Europeans under an “Early Warning” agreement negotiated after the last Ukrainian gas cutoff that they had already cut gas flows to Belarus by 15% and that would increase cuts to 85% by the end of the week. Not very good news for the Belarusians who enjoy the most gasified economy in the world - everything there runs on gas.

A Smiling Medveded

In Denmark last Tuesday, President Medvedev said he had a smiling face for the world. Not surprising. The deal he is reported to have done with President Yanukovitch should bring smiles to many Russian faces - mostly in the Kremlin. However, it is unlikely that the President’s namesake in Gazprom, Alexandre Medvedev is smiling because his company’s interests have once again been subordinated to Russia’s foreign policy agenda.

Support independent French research

Ifri, a foundation recognized as being of public utility, relies largely on private donors – companies and individuals – to guarantee its sustainability and intellectual independence. Through their funding, donors help maintain the Institute's position among the world's leading think tanks. By benefiting from an internationally recognized network and expertise, donors refine their understanding of geopolitical risk and its consequences on global politics and the economy. In 2024, Ifri will support more than 70 French and foreign companies and organizations.