Solar Photovoltaic Energy Policy in Europe: Losing Sight of What is Right: Current Developments and Lessons Learned for Policymakers and Industry

Europe has set ambitious but drastic targets in order to fight climate change. The 20-20-20 objectives demonstrate this. By 2020, emissions are to be reduced by 20%, the share of renewable energy sources (RES) in energy consumption is targeted to rise to 20%, and energy efficiency is planned to increase by 20% in comparison to the 1990 levels in Europe.

In order for Europe to reach these objectives, national targets for each Member State have been set. While not yet officially binding, the 2050 Roadmap of the Commission is focused on achieving even stronger reductions, namely a reduction of 80% in emissions compared to 1990 levels. The 2020 objectives account for less than half of these 2050 objectives.

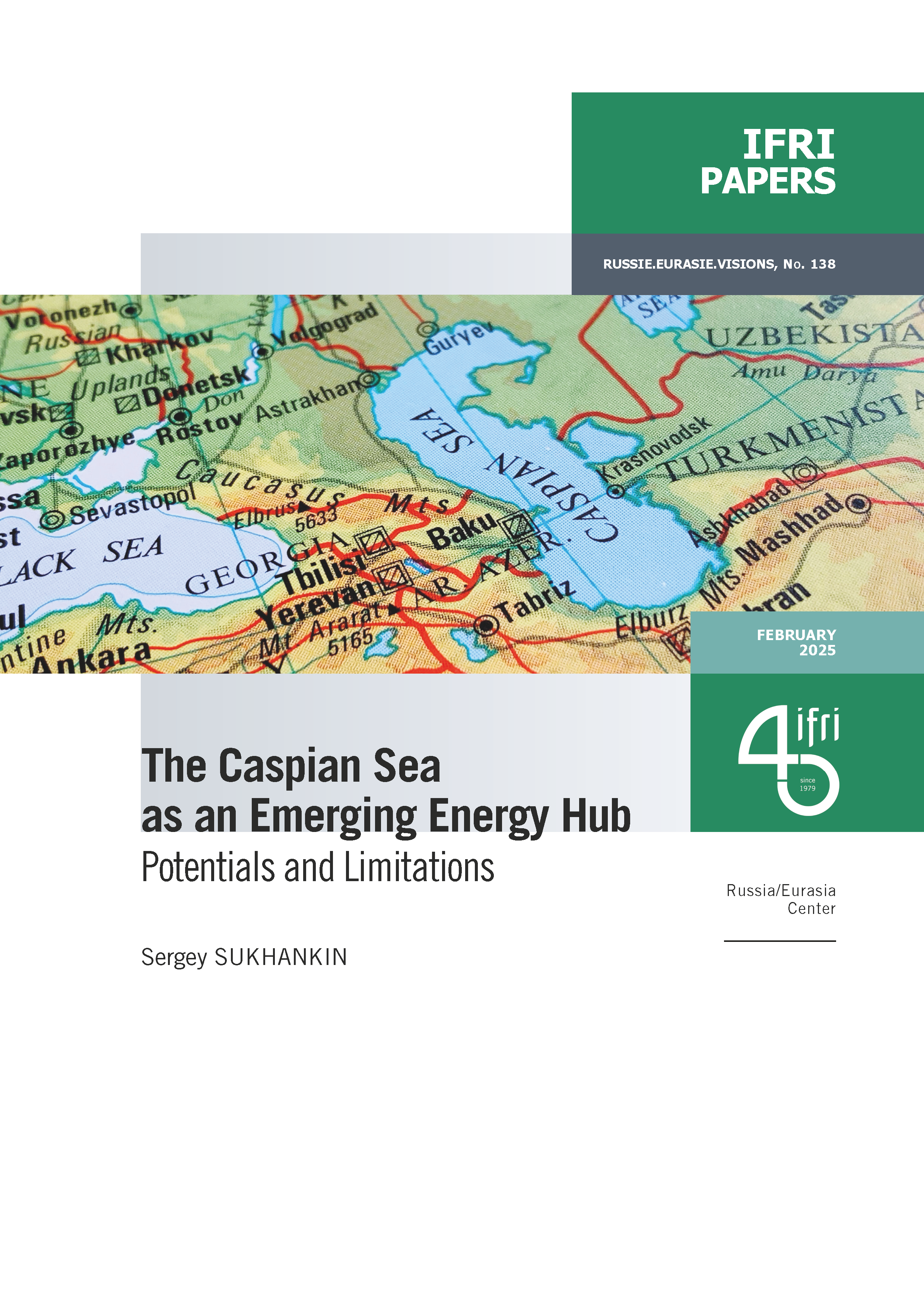

Consequently, Member States are currently under pressure to formulate efforts seriously to comply with their national and European targets as part of the objective of sustainability. European countries have increased capacity of renewables: hydroelectric power, wind power, biomass and solar energy are increasingly produced. As part of the planned renewable electricity capacities for 2020, solar photovoltaic panels (PVs) are the third largest installed RES source, after hydroelectric capacity and wind capacity.

PV is an interesting renewable source for several reasons. First, PV uses an energy source which is available daily: the sun. Secondly, PV has shown positive cost and efficiency improvements over time, which makes it increasingly interesting from a business perspective. It is assumed that PV will provide electricity at competitive prices soon in some countries. Thirdly, PV is one of the few domestically usable applications for electricity generation. This might shift the position of consumers to being co-producers or so-called prosumers. These are a few of the reasons that explain the interest in analyzing efforts linked to PV.

From an industrial point of view, PV panels are produced in-and outside Europe. Looking from a European perspective, it is interesting to examine China and the United States in regard to PV manufacturing and installation capacity. China may be characterized by its high and early PV production, exporting almost 90% of its output. What will this and other developments mean for European PV industry and job creation?

At present, the deployment of PV is under much discussion in many countries, within and outside of Europe. Changes in Feed-in-Tariffs (FIT) are following each other closely and motivations behind deployment are presently frequently discussed in the political sphere. Still, there are important points to consider. What are the costs of PV? How are the costs expected to decrease and how effective are current policies concerning PV penetration? Are these policies also effective in eventually reaching the CO2 reduction targets? PV technologies are still developing and it is important to not be moved by assumptions on efficiencies or effectiveness of the technology.

The aim of this report is to provide recommendations for the debate concerning PV deployment in Europe and to provide suggestions for both policymakers and industry in- and outside of Europe. This is done by analyzing the main developments related to PV worldwide. The report will furthermore present technical developments of PV and will present a comparison in the international context with US and Asia.

In Section 2, the position of PV policy is given within the EU renewable projections for 2020. Before continuing with the support policies for PV in Section 4, the main developments in PV technologies with definitions are provided in Section 3. Afterwards, case studies of the five major European countries with the largest European installed capacities in PV are presented with their efforts and policies associated to PV in Section 5. In Section 6, an evaluation of the European Policy is presented, after which a brief review of the US and China and their PV industries is given with their policy incentives to increase PV installation in Section 7. Finally, this report ends with a conclusion in Section 5, providing the recommendations for policymakers and industries in a global context.

This study only focuses on Solar Photovoltaics, and not on Thermal Solar energy (which uses the heat to generate electricity). Additionally, the reader should be warned that FIT and PV connected regulation is constantly changing. Due to this, data given might not all be totally up to date when this report is published.

Available in:

Regions and themes

ISBN / ISSN

Share

Download the full analysis

This page contains only a summary of our work. If you would like to have access to all the information from our research on the subject, you can download the full version in PDF format.

Solar Photovoltaic Energy Policy in Europe: Losing Sight of What is Right: Current Developments and Lessons Learned for Policymakers and Industry

Related centers and programs

Discover our other research centers and programsFind out more

Discover all our analysesAI, Data Centers and Energy Demand: Reassessing and Exploring the Trends

The information and communication technologies sector today accounts for 9% of global electricity consumption, data centers for 1-1.3%, and artificial intelligence (AI) for less than 0.2%. The growing energy demands of cloud services first, and now AI workloads (10% of today’s data centers electricity demand), have exacerbated this trend. In the future, hyperscale data centers will gain shares amongst all kinds of data centers and AI will probably account for around 20% of data centers electricity demand by 2030.

Unlocking India’s Energy Transition: Addressing Grid Flexibility Challenges and Solutions

India is rapidly scaling up its renewable energy (RE) capacity, adding 15–20 GW annually, but the ambitious goal of 500 GW of non-fossil capacity by 2030 is at risk unless the pace accelerates.

Europe’s Black Mass Evasion: From Black Box to Strategic Recycling

EV batteries recycling is a building block for boosting the European Union (EU)’s strategic autonomy in the field of critical raw minerals (CRM) value chains. Yet, recent evolutions in the European EV value chain, marked by cancellations or postponements of projects, are raising the alarm on the prospects of the battery recycling industry in Europe.

The New Geopolitics of Energy

Following the dramatic floods in Valencia, and as COP29 opens in Baku, climate change is forcing us to closely reexamine the pace—and the stumbling blocks—of the energy transition.