The Next Wave of Global LNG Investment Is Coming

With an annual growth of 10% in 2017 to 290 million tons (Mt) and 8.3% in the first half of 2018, Liquified Natural Gas (LNG) demand is rising faster than expected. Accounting for 44% of global demand growth in 2017, China is the main driver of the growth as the government has made natural gas a key policy choice to reduce air pollution and restructure its high-carbon energy mix.

The Trump-led Trade War with China: Energy Dominance Self-destructed?

Under particular US legal rationale, such as calling foreign imports a “national security threat”, President Donald Trump has started imposing tariffs and/or quotas and has launched national security investigations on a growing number of imported goods from US allies and others alike.

L’Égypte, nouvelle plateforme gazière en Méditerranée orientale

Recent offshore gas discoveries in the Eastern Mediterranean, primarily in Egypt as well as in Israel, but also around Cyprus, are dramatically changing these countries' energy perspectives and economies, and also influence geopolitical balances in the region.

Romania: a key player in the Energy Union for the security of natural gas supply?

In 2015, Maroš Šefcovic, Vice President of the European Commission for Energy Union, was writing about Romania as being «at a crossroads - both in strategic and physical terms.

New and Emerging LNG Markets: The Demand Shock

Over the past decade, an increasing number of emerging markets has joined the liquefied natural gas (LNG) import club.

Trump's Tax Reform and Trade Policy: Renewables Spared, Oil Industry Wins

The energy sector is one where the break between the Trump and Obama administrations is the most pronounced. The three officials in charge, Rick Perry at the Department of Energy (DoE), Scott Pruitt at the Environmental Protection Agency (EPA) and Ryan Zinke at the head of the Department of the Interior (DoI), share the same indifference to the issue of climate change, the same will to encourage oil and gas production in the USA in order to bring an era of American “energy dominance”, the same desire to promote the extraction of “beautiful, clean coal”, to paraphrase President Trumps’s State of the Union address, and the same deep mistrust of renewable energies such as wind and solar.

The Gazprom-Naftogaz Stockholm Arbitration Awards: Time for Settlements and Responsible Behaviour

The signing in January 2009 of the gas supply and transit contracts between Gazprom and Naftogaz marked a turning point in Russian-Ukrainian gas relations: yearly intergovernmental, last minute and non-transparent winter deals were replaced by a predictable, long term commercial relationship.

What Perspectives on the US Oil Policy ?

This Edito highlights how oil, since its discovery in 1859, has played a major role in the US international policy and economy throughout decades, becoming a key tool of the american leadership.

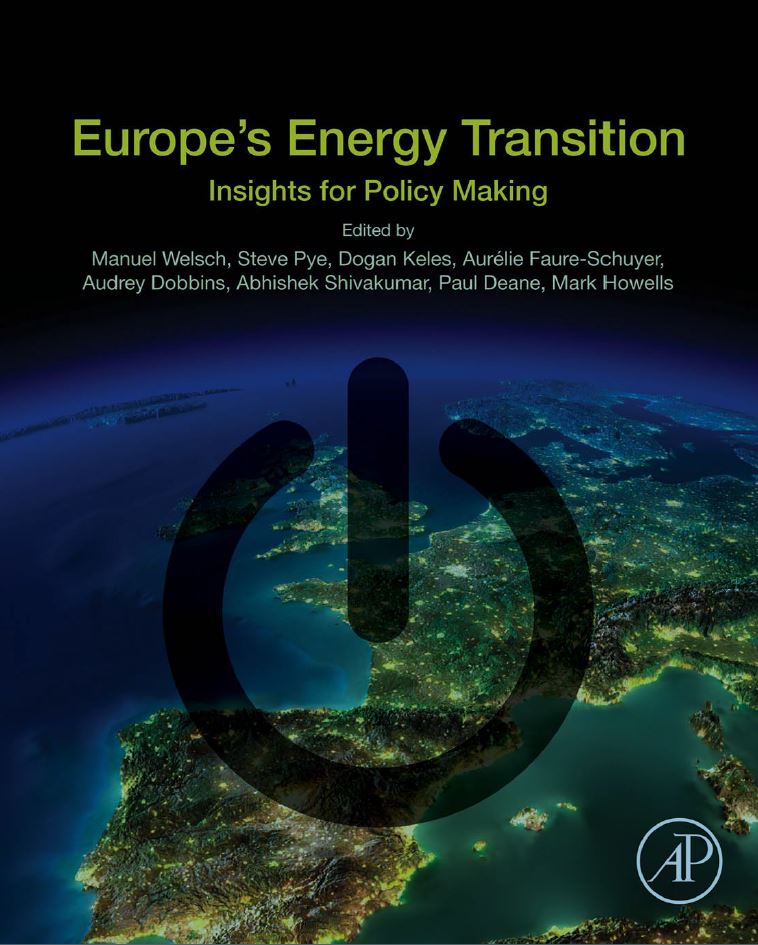

Europe's Energy Transition - Insights for Policy Making

This book was authored by the Insight_e European consortium, in which the Ifri Center for Energy was involved between 2014 and 2017. It is based on the key research projects carried out over the last three years on the Energy Union, greenhouse gas emissions reduction policies, security of gas and electricity supplies and the societal dimensions of the energy transition.

A Point of View on the UK Energy Policy

The United Kingdom chose to leave the European Union at a crucial moment for the Energy Union, and in a period when the necessity of leading a coherent energy transition is strongly shared by EU countries. In the light of this conjunction of events, this study analyses the determining factors of the UK energy policy.

The EU internal market - a stake or a tool in European-Russian gas relations. The case of new member states gas policy

Since 2010 we have observed a new quality in EU energy policy. It is related to the European Commission’s more or less direct engagement in the bilateral gas relations of a part of the new member states - Poland, Bulgaria and Lithuania - with Russia.

Decoupling the Oil and Gas Prices: Natural Gas Pricing in the Post-Financial Crisis Market

This paper looks into natural gas pricing in the post-financial crisis market and, in particular, examines the question whether the oil-linked gas pricing system has outlived its utility as global gas markets mature and converge more rapidly than expected and as large new resources of unconventional gas shift the gas terms-of-trade.

Gas Pains: What to Do About France's Shales

Like other countries in Europe, France has the potential to produce both oil and gas from shale. In the Paris Basin, where oil has been exploited for decades, oil shale quite similar to the Bakken play in North America has considerable promise due to new drilling and exploitation techniques. The potential for shale gas in the South east is less well known and needs to be assessed.

Rising (Oil-linked) Gas Prices: A Message from Shale Gas

One benefit that should flow soon from large new sources of shale gas that have been and will be unleashed into world markets - is the realization that gas prices linked to oil prices don’t make sense any more.

The Effects of Baghdad Politics on Kurdistani Gas Prospects

This paper examines the effects of internal Iraqi politics on the potential for exporting Kurdistani natural gas. It examines Baghdad’s policy with regards to both oil and gas, and predicts what effects it will have on Kurdistan’s gas prospects.

Oil and Gas Delivery to Europe: An Overview of Existing and Planned Infrastructures. New Edition

The European Union’s hydrocarbon energy supply depends heavily on imports. While the European Commission has recommended diversifying and increasing domestic resources, notably with renewable resources which should grow to 20% by 2020, dependence on hydrocarbon imports will remain not only substantial, but will increase.

Nordstream: Just-in-time?

Last week the gritty Russian/Ukrainian gas relationship was back in the press. This time the issue appeared to be Ukraine’s efforts to secure lower prices for its consumers - perhaps even on a par with Russia’s domestic consumers. The Ukrainians must surely know that to qualify for those kinds of special prices available previously only to politically compliant neighbors - Ukraine would have to return to some form of pre-Orange Revolution relationship with Mother Russia.

The EU's Major Electricity and Gas Utilities since Market Liberalization

A major change has taken place in the company structure of the European electricity and gas markets. Twenty years ago, national or regional monopolies dominated the markets and there was strictly no competition between utilities. But since the liberalization of EU energy markets began in the 1990s, companies like E.ON, GDF Suez, EDF, Enel, and RWE have become European giants with activities in a large number of Member States.

An Azeri-Turkish deal on gas - a partnership renewed

The package of the Azeri-Turkish gas agreements signed in Istanbul on June 7, 2010, in the presence of President Ilham Aliyev and Prime Minister Recep Erdogan certainly makes cooperation easier in a sector which both parties consider to be strategic. It does not, however, specify all details of the sale and transit of gas (see e.g. EurasiaNet, 7 June). The documents above all have important political significance.

Russian Gas Diplomacy

Thank goodness our early warning systems during the cold war were not structured so we could see the flash at the same time we heard the warning. On Monday, the Russians notified the Europeans under an “Early Warning” agreement negotiated after the last Ukrainian gas cutoff that they had already cut gas flows to Belarus by 15% and that would increase cuts to 85% by the end of the week. Not very good news for the Belarusians who enjoy the most gasified economy in the world - everything there runs on gas.

Support independent French research

Ifri, a foundation recognized as being of public utility, relies largely on private donors – companies and individuals – to guarantee its sustainability and intellectual independence. Through their funding, donors help maintain the Institute's position among the world's leading think tanks. By benefiting from an internationally recognized network and expertise, donors refine their understanding of geopolitical risk and its consequences on global politics and the economy. In 2024, Ifri will support more than 70 French and foreign companies and organizations.