Center for Energy & Climate

Ifri's Energy and Climate Center carries out activities and research on the geopolitical and geoeconomic issues of energy transitions such as energy security, competitiveness, control of value chains, and acceptability. Specialized in the study of European energy/climate policies as well as energy markets in Europe and around the world, its work also focuses on the energy and climate strategies of major powers such as the United States, China or India. It offers recognized expertise, enriched by international collaborations and events, particularly in Paris and Brussels.

Read more

Director, Center for Energy & Climate, Ifri

Publications

See all our interventions

Flagship Publications

Titre Bloc Axe

Research Areas

See all our interventions

Titre Axe de recherche

Geopolitics of Fossil Fuels

The Geopolitics of Fossil Fuels research axis within Ifri's Center for Energy and Climate deals with global geopolitical trends of the oil, gas and coal sectors, with a focus on short and longer term trends in demand and supply.

Titre Axe de recherche

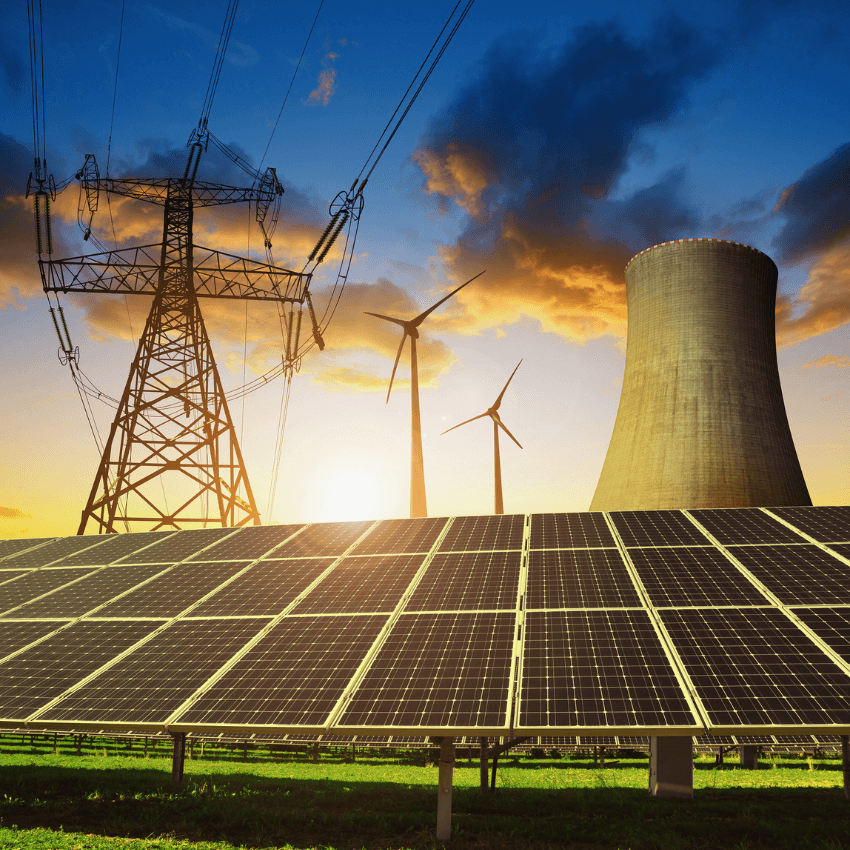

Major Stakes of the Electricity Sector

The Major Stakes of the Electricity Sector research axis within Ifri's Center for Energy & Climate focuses on the economic and geopolitic transformation of the electricity sector, at French, European and global levels. A specific attention is devoted to the future of the nuclear industry and the strong development of renewable energy sources.

Titre Axe de recherche

European Energy Policy

The European Energy Policy research axis within Ifri's Center for Energy & Climate examines the major policy regulatory issues of the European internal and external energy policies, with a focus on the integration of energy markets and the deployment of low-carbon technologies.

Titre Axe de recherche

Climate Policies and Energy Transition

The Climate Policies & Energy Transition research axis within Ifri's Center for Energy & Climate deals with the climate change policies adopted at national levels, as well as the positions of the main emitting countries in the international climate negotiations. In particular, this area focuses on the implementation of the Paris Agreement on climate and global efforts to reduce green-house gas emissions to limit the increase of temperature at +1,5° by 2100.

The Team

Our research fellows: Center for Energy & Climate

Publications

The Conundrum of the Southern Gas Corridor: What are the Risks for Europe and Azerbaijan? The viewpoint of an insider

For more than ten years, harsh negotiations among different oil majors and pipeline consortia have been taking place about the Southern Gas Corridor, all of them seeking to transit 10 bcm/year of natural gas that will be produced from the Shah Deniz giant gas field of Azerbaijan to the European Union. As of today, no Final Investment Decision (FID) has been reached neither for the preferred pipeline route to Europe, nor for the production of the second phase of Shah Deniz.

The European Commission Energy Green Paper: A Draft to Be Revised

The European Commission has just made public a green paper devoted to its energy and climate policies until 2030.

The European Refining Crisis: What is at stake for Europe?

The European Refining sector is in crisis. The wave of refineries closures has spared no EU Member States.

Global Coal Trade from Tightness to Oversupply

Over the past four years, international coal trade has been reshaped by China’s surging imports.

Powering Kuwait into the 21st Century: Alternatives for Power Generation

Kuwait is facing a surge in the consumption of power. The current power fuel mix, based on oil, appears unsustainable. Yet Kuwait has a large number of assets.

Solar Photovoltaic Energy Policy in Europe: Losing Sight of What is Right: Current Developments and Lessons Learned for Policymakers and Industry

Europe has set ambitious but drastic targets in order to fight climate change. The 20-20-20 objectives demonstrate this. By 2020, emissions are to be reduced by 20%, the share of renewable energy sources (RES) in energy consumption is targeted to rise to 20%, and energy efficiency is planned to increase by 20% in comparison to the 1990 levels in Europe.

What Role for the EU in Doha?

Historical leader of the fight against climate change, the European Union’s influence declined in Copenhagen. This opened the way to the so-called BASIC countries to show their willingness to become a driving force in the international climate agenda. Interestingly enough, the Copenhagen conference also introduced a welcome shift in the traditional UN separation between developed and non-developed countries.

The European Coal Market: Will Coal survive the EC's Energy and Climate Policy?

The European coal industry is at a crossroads. The European Commission (EC) Energy Policy by 2020, the 20/20/20 targets, is not favourable to coal:

a 20% decrease in CO2 emissions does not favour coal compared with natural gas, its main competitor in electricity generation;

a 20% increase in energy efficiency will lead to a decrease in energy/coal consumption;

a 20% increase in renewables will displace other energy sources, including coal.

Towards Gas-on-Gas Competition in Europe from Trends to Reality?

Last week Centrica announced having signed a three-year gas supply contract with Gazprom Marketing and Trading UK entirely priced against UK spot gas market (NBP). This move follows other announcements in the sector, such as EON long-term gas supply contracts renegotiation, which allowed it to almost double its net-profit forecasts for 2012, or BP intention to sell Shaz Deniz II gas with spot-indexed contracts. All major European suppliers have been able to renegotiate long-term oil-indexed contracts with Gazprom lately and, more generally, contracts are increasingly being based on some spot-indexed price formula. How could that happen and what does it mean?

Capacity Mechanisms : EU or National Issue? Are Capacity Remuneration Mechanisms Helping to Build the Market or Just a Symptom of What Does Not Work ?

In a competitive energy system, generation investment choices are let to investors. It is then the responsibility of the market actors to invest and ensure peak, medium and base load generation, based on market perspectives and trends. If through actors" investments the stability of the system cannot be ensured (because, for example, peak generation is not sufficient to satisfy demand), some measures have to be taken. These can have economic and system integrity impacts on neighboring systems, especially if they are connected. This is precisely what is happening in the European electricity market.

Support independent French research

Ifri, a foundation recognized as being of public utility, relies largely on private donors – companies and individuals – to guarantee its sustainability and intellectual independence. Through their funding, donors help maintain the Institute's position among the world's leading think tanks. By benefiting from an internationally recognized network and expertise, donors refine their understanding of geopolitical risk and its consequences on global politics and the economy. In 2024, Ifri will support more than 70 French and foreign companies and organizations.